A couple reviewing tax forms to report capital gains and losses." width="400" height="200" />

A couple reviewing tax forms to report capital gains and losses." width="400" height="200" /> A couple reviewing tax forms to report capital gains and losses." width="400" height="200" />

A couple reviewing tax forms to report capital gains and losses." width="400" height="200" />

When you sell an asset for more than you paid for it, the profit you make is considered a capital gain and must be reported to the IRS. Understanding how to use Schedule D to report these gains will help you file your taxes accurately and avoid potential penalties.

If you have questions about how capital gains taxes can impact your financial plan, consider reaching out to a financial advisor.

To determine a capital gain or loss, you will first need to know the cost basis. This is the original purchase price of the asset, including any associated costs such as commissions and fees. So when an asset is sold, the capital gain or loss is determined by subtracting the asset’s basis from the selling price. If the selling price is lower than the basis, it results in a capital loss. And if it’s higher, you will have a capital gain.

For example, if you buy a stock for $1,000 (your basis) and later sell it for $800, you would have a capital loss of $200. But, if you bought it for $1,000 (your basis) and sold it for $1,500, you would have a capital gain of $500.

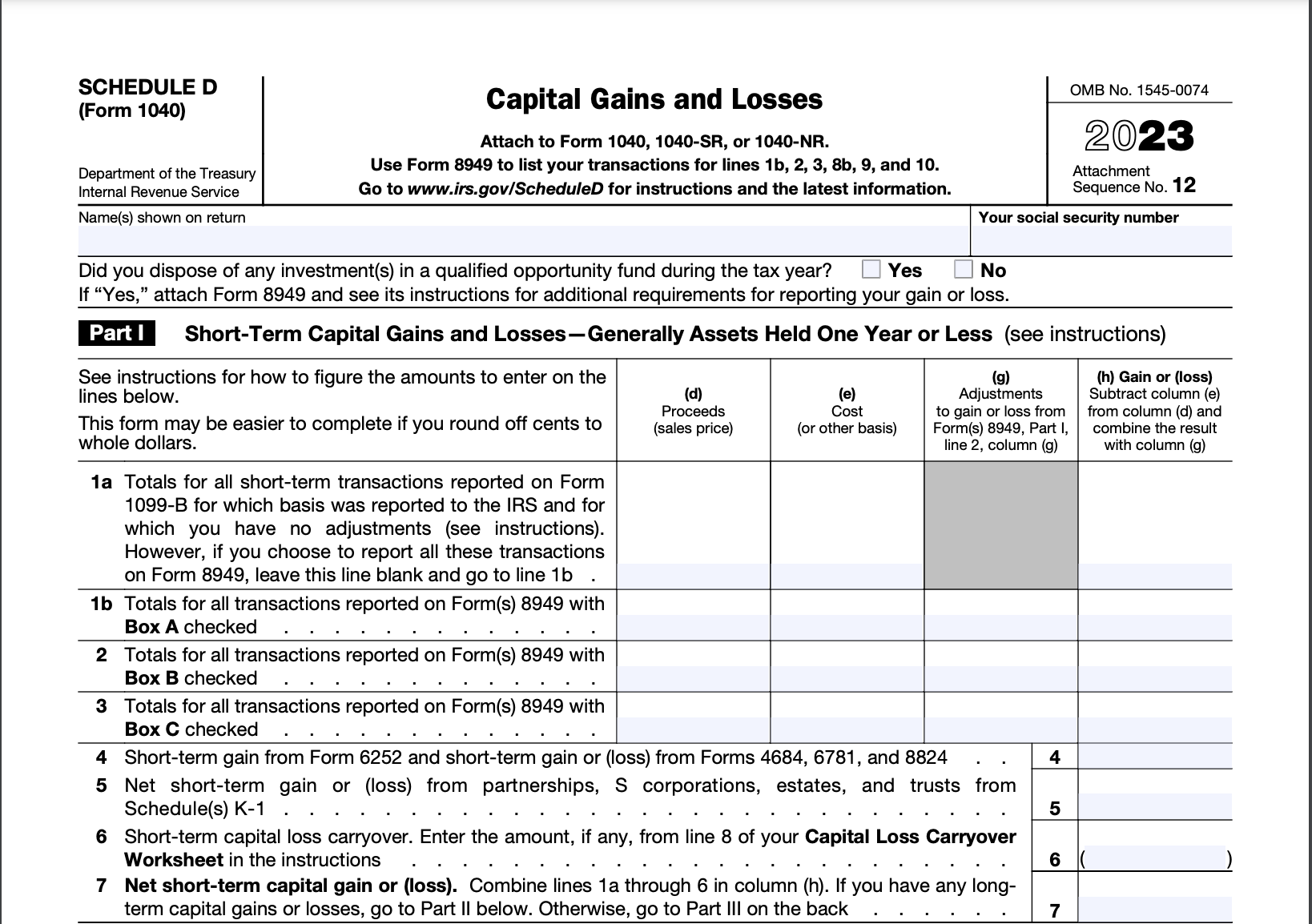

Schedule D is a tax form used by the IRS to report capital gains and losses from the sale of personal assets. It includes information about the profits or losses incurred from selling stocks, bonds, personal real estate and other investment properties. Completing Schedule D helps calculate your total capital gain or loss, which is then transferred to your main tax return, Form 1040.

Anyone who has realized capital gains or losses during the tax year needs to file Schedule D. This applies whether you have sold stocks, bonds, mutual funds or other investments. Even if you had only a few transactions, you have to report them accurately. Understanding how to report capital gains on your tax return can help you avoid errors and potential penalties.

Reporting capital gains on your tax return involves the following steps:

Capital gains are either short-term or long-term, depending on how long you’ve held the asset before selling it. Short-term capital gains come from the sale of assets held for one year or less. These gains are taxed at your ordinary income tax rates, which can be as high as 37%, depending on your income bracket.

Long-term capital gains, on the other hand, come from assets held for more than one year. These gains benefit from lower tax rates, typically 0%, 15% or 20%, based on your taxable income. For example, if your taxable income is up to $47,025 for single filers or $94,050 for married couples filing jointly for tax year 2024, you might qualify for the 0% tax rate on long-term capital gains. The favorable tax treatment of long-term gains is designed to encourage long-term investment.

When you report your gains on IRS Form 8949, you’ll report short-term gains in Part I and long-term gains in Part II. Correct classification and reporting of short-term and long-term gains are vital to accurately determine your tax liability and take advantage of the lower tax rates on long-term investments.

Offsetting is the process of reducing a tax liability by applying losses against gains to lower the overall taxable amount.

One strategy to offset capital gains is to intentionally offset your capital gains with capital losses. This practice is known as tax-loss harvesting, which is the deliberate sale of losing investments for the purpose of offsetting capital gains. However, you should note that you can still offset capital gains even without engaging in this strategy. The IRS allows you to offset gains with any losses you have incurred within the same tax year.

If your losses exceed your gains, you can deduct up to $3,000 of the remaining losses against your other income through tax-loss harvesting. You can also carry any losses beyond this limit to offset gains in future years, providing ongoing tax benefits.

To report capital gains on your tax return, use Schedule D to detail your gains and losses from the sale of assets. You will also need to categorize your losses based on the holding period of the assets (short- or long-term) and then transfer the totals to your main tax return, where applicable deductions can be applied. And finally, to offset any capital gains, subtract your capital losses from your capital gains on Schedule D, thereby reducing your taxable income and potentially lowering your tax liability.

Photo credit: ©iStock.com/SDI Productions, ©iStock.com/Szepy, ©IRS.gov

Read More About Investing

More from SmartAsset

SmartAsset Advisors, LLC ("SmartAsset"), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. Securities and Exchange Commission as an investment adviser. SmartAsset's services are limited to referring users to third party advisers registered or chartered as fiduciaries ("Adviser(s)") with a regulatory body in the United States that have elected to participate in our matching platform based on information gathered from users through our online questionnaire. SmartAsset receives compensation from Advisers for our services. SmartAsset does not review the ongoing performance of any Adviser, participate in the management of any user's account by an Adviser or provide advice regarding specific investments.

We do not manage client funds or hold custody of assets, we help users connect with relevant financial advisors.

This is not an offer to buy or sell any security or interest. All investing involves risk, including loss of principal. Working with an adviser may come with potential downsides such as payment of fees (which will reduce returns). There are no guarantees that working with an adviser will yield positive returns. The existence of a fiduciary duty does not prevent the rise of potential conflicts of interest.