Upsolve is a nonprofit that helps you get out of debt with free debt relief tools and education. Featured in Forbes 4x and funded by institutions like Harvard University so we'll never ask you for a credit card. Get debt help.

In a NutshellPennsylvania has two state debt collection laws: the Pennsylvania Fair Credit Extension Uniformity Act (FCEUA) and the Pennsylvania Unfair Trade Practices and Consumer Protection Law (UTPCPL). Combined, these two laws provide important protections for state residents against both original creditors and third-party debt collectors. Pennsylvanians get further protections from the federal Fair Debt Collection Practices Act (FDCPA) offered to all states. The statute of limitations for all debt contracts (including credit cards and medical bills) in Pennsylvania is four years.

Pennsylvania has two state debt collection laws: the Pennsylvania Fair Credit Extension Uniformity Act (FCEUA) and the Pennsylvania Unfair Trade Practices and Consumer Protection Law (UTPCPL). These laws work together to protect Pennsylvania residents: The FCEUA specifies what debt collection activities are unlawful, and the UTPCPL gives prosecutors and/or consumers the right to take action for FCEUA violations.

The FCEUA establishes what acts (or practices) are considered unfair or deceptive in the realm of debt collection, beyond the Fair Debt Collection Practices Act (more on this act below). The FCEUA applies to both third-party debt collectors and original creditors.

This act doesn’t apply to purchase-money mortgages on real estate, but does apply to home equity loans. It also doesn’t apply to federal tax debt or tax debt owed to the state of Pennsylvania, but does apply to all other taxes, interest, and penalties.

The FCEUA itself doesn’t allow the right to sue the creditor or the debt collector in civil court, but Pennsylvania courts allow consumers to use the Unfair Trade Practices and Consumer Protection Law (UTPCPL) to sue for FCEUA violations in civil court.

The UTPCPL gives consumers the right to sue debt collectors or creditors who violate the Fair Credit Extension Uniformity Act (FCEUA). You can sue the creditor/debt collector in a state civil court, but only if you’ve suffered an “ascertainable loss of money or property” as a result of the violation. In other words, you’ll need to show the court that you’ve suffered a concrete and quantifiable loss, such as money lost due to the debt collector unlawfully charging fees or interest.

If you’re successful in court, the judge can award you up to triple the actual damages, plus attorney fees and costs.

Both of Pennsylvania's state laws work alongside the federal Fair Debt Collection Practices Act (FDCPA). This federal law protects consumers from harassment and abusive debt collection practices. Every citizen in Pennsylvania is protected under the FDCPA.

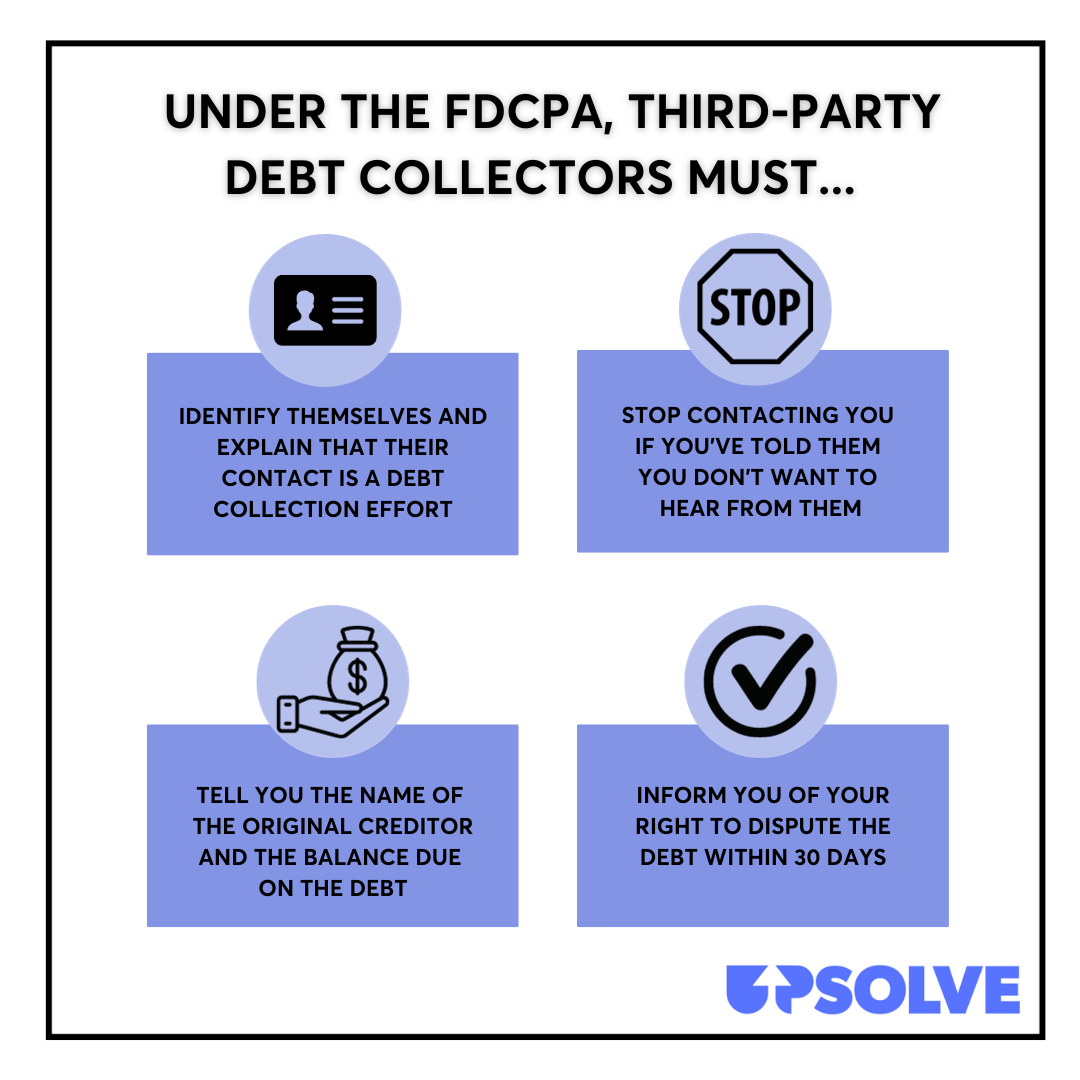

Here’s an overview of the law:

The main purpose of the FDCPA is to provide protections for consumers against third-party debt collectors. It also outlines what certain responsibilities debt collectors have.

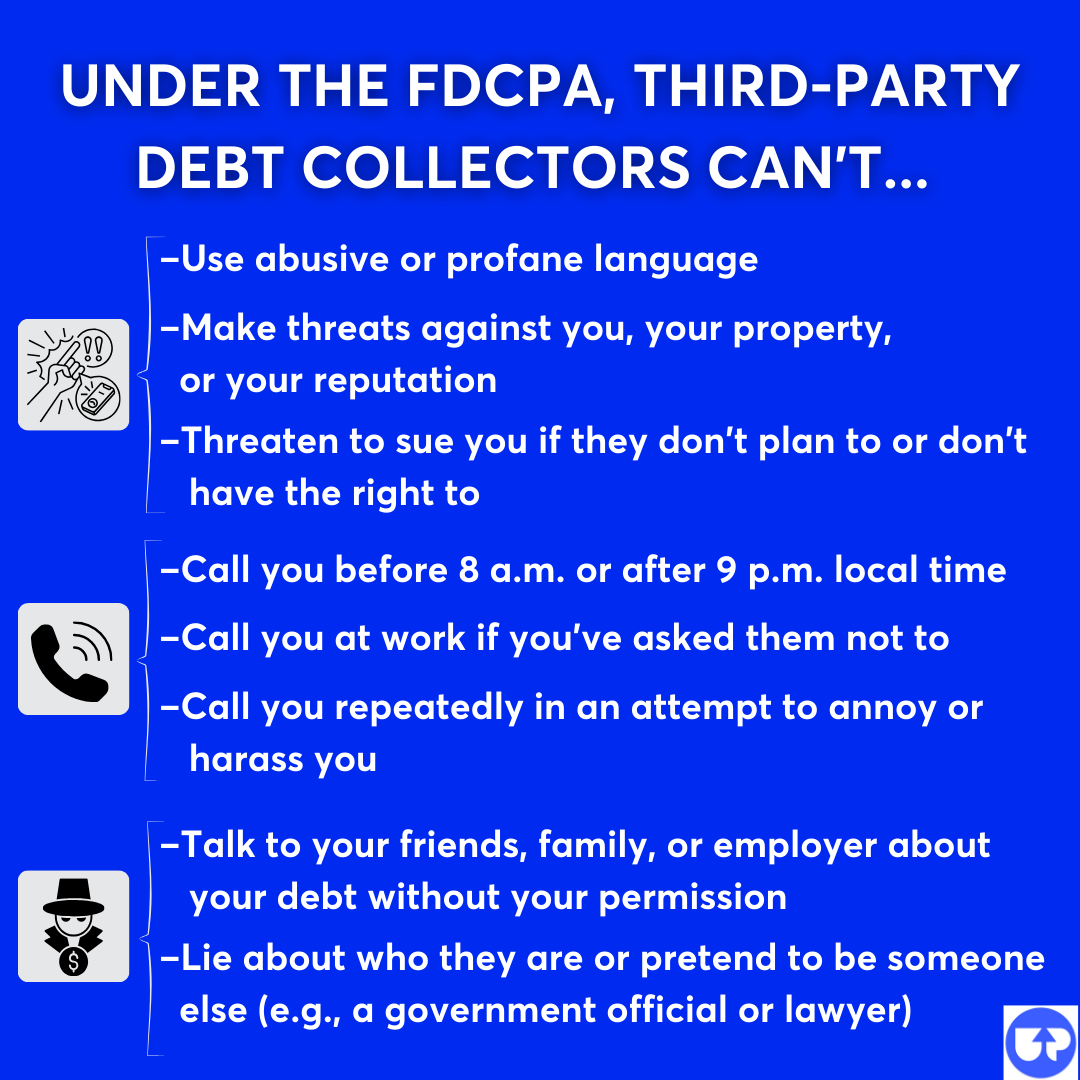

While it does outline what debt collectors can do, the FDCPA also outlines what third-party debt collectors can’t do:

Not every state provides protections beyond the FDCPA for its residents. Pennsylvania, however, does provide additional protections beyond the FDCPA.

Though the FCEUA doesn’t create additional protections for consumers that aren’t already in the FDCPA, it does expand some of the FDCPA’s provisions to apply to original creditors. The FDCPA only applies to third-party debt collectors, so Pennsylvania’s state law provides greater protections for consumers

In Pennsylvania, the statute of limitations to bring legal action against creditors and debt collectors is two years. In other words, you have two years after a violation to file a lawsuit in Pennsylvania if a debt collector or creditor violates state law. By contrast, under the FDCPA, consumers must bring legal action within one year after a violation.

If you think a debt collector has broken the law by violating either of Pennsylvania’s debt collection laws or the federal FDCPA, you can submit a complaint to the Pennsylvania attorney general’s office.

If you’ve suffered actual damages (monetary losses or harm) as a result of an FCEUA violation, you can even sue the creditor or debt collector in Pennsylvania state court. You can also bring a lawsuit in federal court for FDCPA violations.

If you can prove that a debt collector violated the FDCPA, then that means you can also show they violated the FCEUA and the UTPCPL. You don’t have to show separate proof for each one. That said, you can't hold them liable under both state and federal laws for the same activity. If you do follow through with a lawsuit, you’ll have to decide which laws to collect under.